arizona solar tax credit 2019

The federal residential solar energy credit is a tax credit that can be. Arizona Residential Solar Energy Tax Credit Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year.

Solar Tax Credits 2020 Blue Raven Solar

Make the best out of 2019.

. Arizona will give a business a tax credit for 10 of the system cost up to 25000 for any one building in the same year and 50000 per business in total credits in one year. 23 rows Did you install solar panels on your house. Arizona Department of Revenue tax credit.

It is a 25 tax credit on product and installation for both 2020 through 2023. Here are the specifics. This incentive is an Arizona personal tax credit.

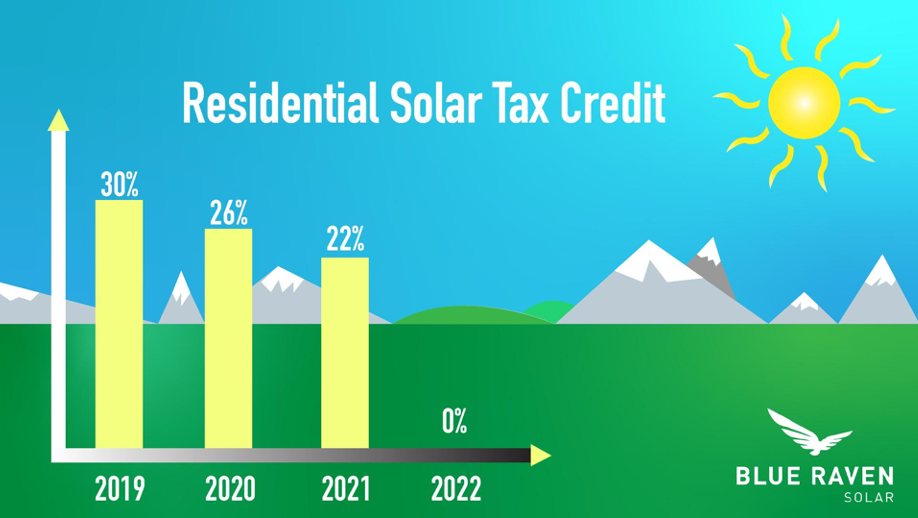

Solar energy systems in Arizona get a tax credit equivalent to 25 of their value or 1000 whichever is less. You can only claim up to 1000 per calendar year on your state taxes. 30 for systems placed in service by 12312019 Expired 26 for systems placed in service after 12312019 and before.

There is no maximum amount that can be. According to recent data a 5 kilowatts kW solar installation in Arizona averages between 12495 and 16905 in cost with an average gross price of 14700. Arizona Renewable and Solar Energy Incentives.

The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. Arizona solar tax credit. Currently the credit amount is as follows.

Solar panels are exempt from Arizonas 56 sales tax which means. Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. Shop Northern Arizona Wind Sun for Low Prices Free Ground Shipping For Orders 500.

Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence. Find The Best Option. Ad Check Out Our Wide Variety Of Inventory From Charge Controllers To Inverters To Panels.

June 6 2019 1029 AM. Check Our Easy-To-Read Rankings. Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it.

Yes the solar investment tax credit. Download 13321 KB Download 3925 KB 01012019. Favorable laws rebates property and sales tax.

In addition to Arizonas solar incentives youll be eligible for the federal solar tax credit if you buy your own home solar system outright. Was the federal solar tax credit extended. Provide any combination of the above by means of.

Arizona solar tax credit. Arizona Residential Solar and Wind Energy Systems Tax Credit. The solar Investment Tax Credit ITC is one of the most beneficial federal policies in place to support the expansion of solar energy usage in the United States.

Arizona is a leading state in the national solar power and renewable energy initiative. The tax credit remains at 30 percent. Download 13761 KB Download 162 MB 01012020.

1 Best answer. Form Year Form. It was originally going to drop to 22 in.

In 2019 the maximum credit allowed for single. The credit amount allowed against the taxpayers personal income tax is. The credit is allowed against.

Ad Free Arizona Solar Quotes. Neither Solar Concepts Redilight QuietCool or any product manufacturers are tax consultants. Individual tax credit for an individual who installs a solar energy device in taxpayers residence located in Arizona.

6 The maximum credit in. Ad A Comparison List Of Top Solar Power Companies Side By Side. 25 of the gross system cost up to a maximum of 1000.

The state sales tax of 56 does not apply to solar. To claim this credit you must also. Provide heating provide cooling produce electrical power produce mechanical power provide solar daylighting or.

Talk to the experts at PEP Solar and well give you a free demonstration. Top Solar Power Companies In Your Area. However unlike the federal governments tax credit incentive Arizona tax credits have a limit.

The federal solar tax credit gives you a dollar-for-dollar. This is claimed on Arizona Form 310 Credit for Solar Energy Devices. The Consolidated Appropriations Act of 2021 bill extended the 26 investment tax credit through 2022.

Dont miss out on the 30 Solar Incentive Tax Credit. Arizona solar tax credit 2019 Monday March 21 2022 Edit.

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Guide To Residential Solar Panels In Richmond Va 2021

Solar Tax Credit In 2021 Southface Solar Electric Az

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

California Solar Incentives And Rebates Available In 2022

Best States For Solar In 2019 Growth And Payback Energysage

Everything You Need To Know About The Solar Tax Credit Palmetto

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Valley Family Victimized By Solar Power Scam Loses Several Thousand Dollars

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Are Solar Panels Worth It In Arizona Yes Ae Llc

Solar Panels Pros And Cons In Arizona Solar Fix

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website

Solar Tax Credit 2021 Extension What You Need To Know Energysage

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

Commercial Solar Incentives Sunrenu

Free Solar Panels Arizona What S The Catch How To Get

Is Solar Worth It In Arizona Solar Panels Savings Az Solar Website